2/9/25

What I Spent This Week as a Business Manager Making $58k

Ever wondered how others really manage their money?

Ever wondered how others really manage their money?

In the A Week in My Wallet series, we share it all, because talking about money shouldn't be off-limits.

Every week, an anonymous member shares a week of their spending: no names, no filters, just honest stories about life's everyday financial choices.

Ready to join the conversation and help make money talk less taboo? Share your own story via our form here.

About Me

Age: 42

City: Leicester, UK

Current Salary (before tax): £42,800 ($57,856)

Monthly Take-Home Pay (after tax): £2,802 ($3,785)

Household Income (if shared): N/a

Do you share expenses with someone? No

Occupation and/or Source(s) of Income: Business Manager for Community Benefit Society and a Self-Published Author

Savings

£1,080 ($1,458) in one high-interest account for paying the tax bill at the end of the year.

£300 ($405) in another high-interest account, easily withdrawable for emergencies.

Debt

£4,800 ($6,480) with 0% interest on a credit card

Assets

Investments at £300 ($405) (just started my investment journey)

Fixed Monthly Costs (your share only)

Rent / Mortgage: £700 ($945)

Bills & Utilities: £500 ($675

Petrol: £200 ($270)Pets: £100 ($135

Groceries & Essentials: £700 ($945) approx

Debt: £200 ($270)

Investment Contributions: £50 ($67.50)

Savings Contributions: £300 ($405)

I don't follow a formal budget split, but I do ensure my debt, savings, and investments are paid first before anything else. I use The Budget Mom workbook to budget every month, and I check my budget every morning.

Dependents: 2

Money Mindset & Financial Journey

Growing up, did your parents or guardians educate you around money?

I didn't so much get an education around it, but I remember when my parents split, my mother had 4 kids to support. I watched her write out a budget every week, counting the money she had and allocating it where it needed to go. Whatever was left was put aside for emergencies or a rare special treat.

It was like that for maybe 4 years before she met my stepdad. He was comfortable with what he had, enough in savings, but it took a while before she could let go.

Thinking back now, I can see bits from each of them that helped me learn my finance journey from, but it was never something we spoke about as such.

What was your first job and why did you get it? Did you worry about money growing up?

I was 15 years old and wanted to earn some money just for me. I worked at a pharmacy/beauty shop and spent many hours stocking shelves and serving customers.

Every time I got my money, it felt like a revelation. If I did this, then I get this. I didn't worry about it, no. I knew we would have enough, and to be honest, I never knew if we didn't have enough. Mum never disclosed that, but I never felt like I'd missed out.

At 17, I went to college away from home, and my parents paid for my essentials until I dropped out a year later. Then it fell on me to take the weight of my bills.

At what age did you become financially responsible for yourself and do you have a financial safety net? Do you worry about money now?

I suppose I do. My stepdad would never see us without what we needed, but he would also wait for me to ask for help instead of offering - and that's sometimes where I struggle.

I don't like asking for help! Yes, every day. It's a whole other ballgame when you have kids that need stuff, and their very person needs what only you can provide.

What is your biggest money regret?

Spending instead of saving for most of my life. I was very much in the frame of mind that you can't take the money with you so why not spend it on stuff you enjoy. Now though, hindsight is 20/20 as they say. I wish I'd started saving years ago.

What financial goals are you working towards?

I'm working towards getting my emergency fund where I'd be comfortable. It’s going to take time. I've also recently started investing and I can only do £50 ($67.50) a month right now. It's helping to teach me though.

I also want to get rid of my debt, but because it's on 0% interest, I've worked out the minimum to pay to ensure it's paid off in the time frame before I have to pay interest on it.

Who is your financial role model (if any), and why?

The Budget Mom (Kumiko Love). I'd been budgeting for years but when I found her channel, I was obsessed. She has managed to work her way through so many challenges and without detriment to her happiness. It's so inspiring.

Reflections on My Spending

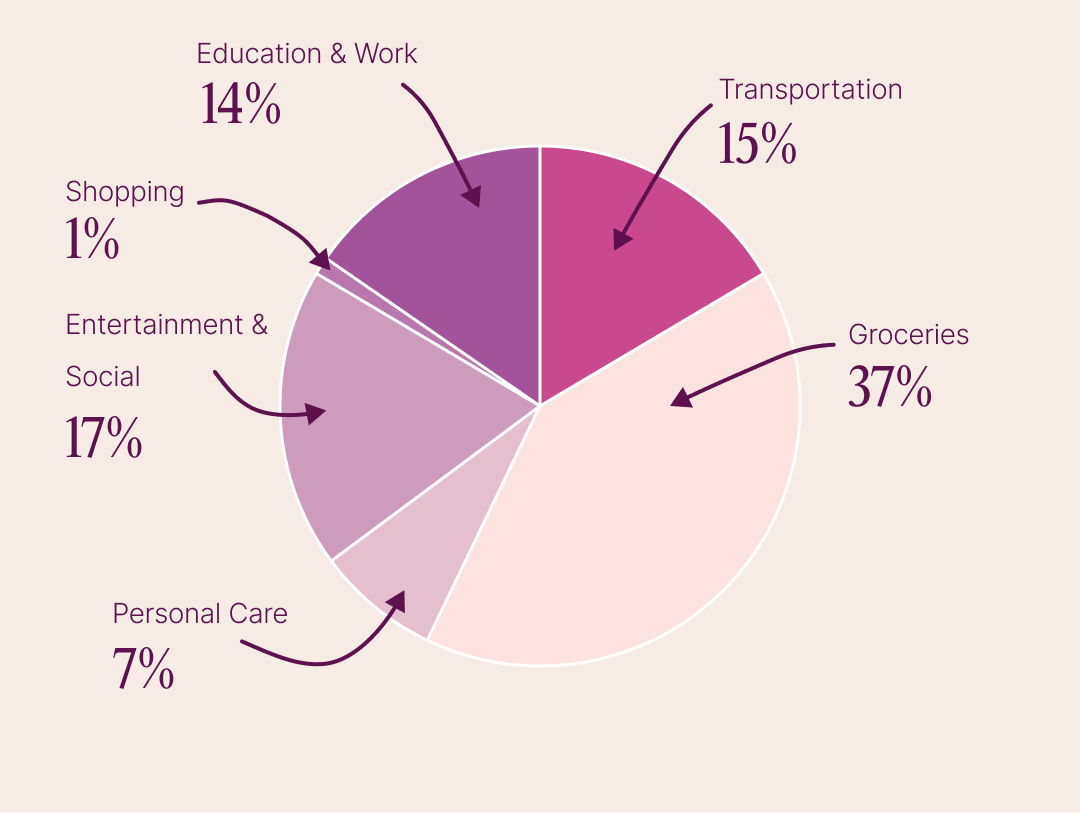

The main things I've noticed are that I spend a lot for my kids and I eat out a lot! It is something I have become aware of and I am trying to cut down as much as possible. Impromptu visits to the corner shop or colleagues inviting me to join them to get their dinner is my biggest downfall.

Other than eating out, I don't do a lot for myself. Which I kind of knew, but seeing it written down like this, it's more visible.

The costs for my son should be lowering soon as he's just finished college and has a driving test to pass!

What I Spent in a Week

Monday £114.35 ($154.37)

Snack: £4.00 ($5.40)

Bus fare for son (monthly): £48.75 ($65.81)

Clothes from charity shop: £7.00 ($9.45)

Trampoline park for daughter: £54.60 ($73.71)

Tuesday £44.78 ($60.42)

Lunch: £11.00 ($14.85)

Line dancing class: £6.00 ($8.10)

Pet insurance: £27.78 ($37.47)

Wednesday £37.00 ($49.95)

Haircut: £33.00 ($44.55)

Snack: £4.00 ($5.40)

Thursday £87.15 ($117.66)

Driving lesson for son: £55.00 ($74.25)

Small grocery shop: £29.00 ($39.15)

Too Good To Go bag: £3.15 ($4.26)

Friday £30.00 ($40.50)

Sign language class: £10.00 ($13.50)

Lunch: £9.00 ($12.15)

Dinner: £11.00 ($14.85)

Saturday £154.65 ($208.73)

Weekly grocery shop: £111.98 ($151.17)

Pet food: £29.67 ($40.01)

Trampoline for my daughter: £13.00 ($17.55)

Sunday £37.67 ($50.82)

Cafe: £8.00 ($10.80)

Petrol: £24.69 ($33.29)

Toiletries: £4.98 ($6.73)

Weekly Total: £474.60 ($640.71)