2/9/25

What I Spent This Week as an Executive Making $107K a Year

Ever wondered how others really manage their money?

Ever wondered how others really manage their money? In the A Week in My Wallet series, we share it all, because talking about money shouldn't be off-limits. Every week, an anonymous member shares a week of their spending: no names, no filters, just honest stories about life's everyday financial choices.

Ready to join the conversation and help make money talk less taboo? Share your own story via our form here.

About Me

Age: 52 years

Location: Denmark

Current Salary: *700.000 kr. ($107,800)

Combined Household Income: 2.000.000 kr. ($308,000)

Occupation: Head of Concept Development

Savings: 260.000 kr. ($40,040)

Debt: 0 kr. ($0)

Assets: Stock investments

Fixed Monthly Costs (your share only):

- Rent / Mortgage: 10.000 kr. ($1,540)

- Bills & Utilities: 5.000 kr. ($770)

- Transport: 800 kr. ($123)

- Groceries & Essentials: 4.000 kr. ($616)

- Investment Contributions: I use my bonus for savings and investment. Previously, I used my bonus to pay off my loans.

Dependents: Married

*Note: this member earns and spends in Danish kroner, but we’ve converted this to USD for you.

Money Mindset & Financial Journey

Did your parents educate you around money?

No!! They were hard workers and had no money left by the end of the month. When there was extra money, it was spent on shopping. From an early age, I was taught that shopping was a good way to make you feel better.

When I got my first Visa card at 18, I overspent. Later, I took out loan after loan, building up a huge amount of debt. I eventually sought treatment 16 years ago. Today, my life has changed upside down. I have no debt. I buy stocks and love to use my money cleverly. I have a high focus on cost and cost savings.

For me, having money means freedom, independence, and control in many aspects. My secret goal is to never be dependent on my husband or anybody!

What was your first job and why did you get it?

Cleaning job (for extra pocket money).

Did you worry about money growing up?

I used to worry about money when I spent because I knew we didn’t have much. It’s not that we ever went without anything during my childhood. We had nice clothes, went on yearly vacations to southern Europe, but by the end of the month, we could feel there wasn’t much left. It was never explicitly said, but it was always in the air. My parents were hard workers, and they wanted to give my two brothers and me everything - good private schools, vacations, and nice clothes. Our home was far from fancy, and by the end of the month, my mother would be looking for spare change in her pockets at home just to buy groceries.

We went to school with some of the wealthiest kids in Denmark, so that’s where I could really feel the difference.

At what age did you become financially responsible for yourself?

At age 19. I had no safety net, but already a student loan.

Do you worry about money now?

Yes, every day, even though today I have healthy finances.

What is your biggest money regret?

All my loans that made my life so complicated and dishonest and full of shame.

To never ask for help or speak openly about money. But again, nobody talked about finances, and no one ever said no to going to a café because we didn’t have the money.

What financial goals are you working towards?

Independence.

Who is your financial role model, and why?

My grandmother was a true inspiration, and I have a great deal of respect for her and the way she always ensured she had enough money. She had a system of splitting her money and placing it into envelopes, each labeled with a category such as "hairdresser," "dentist," "food," and so on. She never overspent. Even though the clothes she wore could be 25 years old, they still looked great because she took such good care of them.

Reflections on My Spending

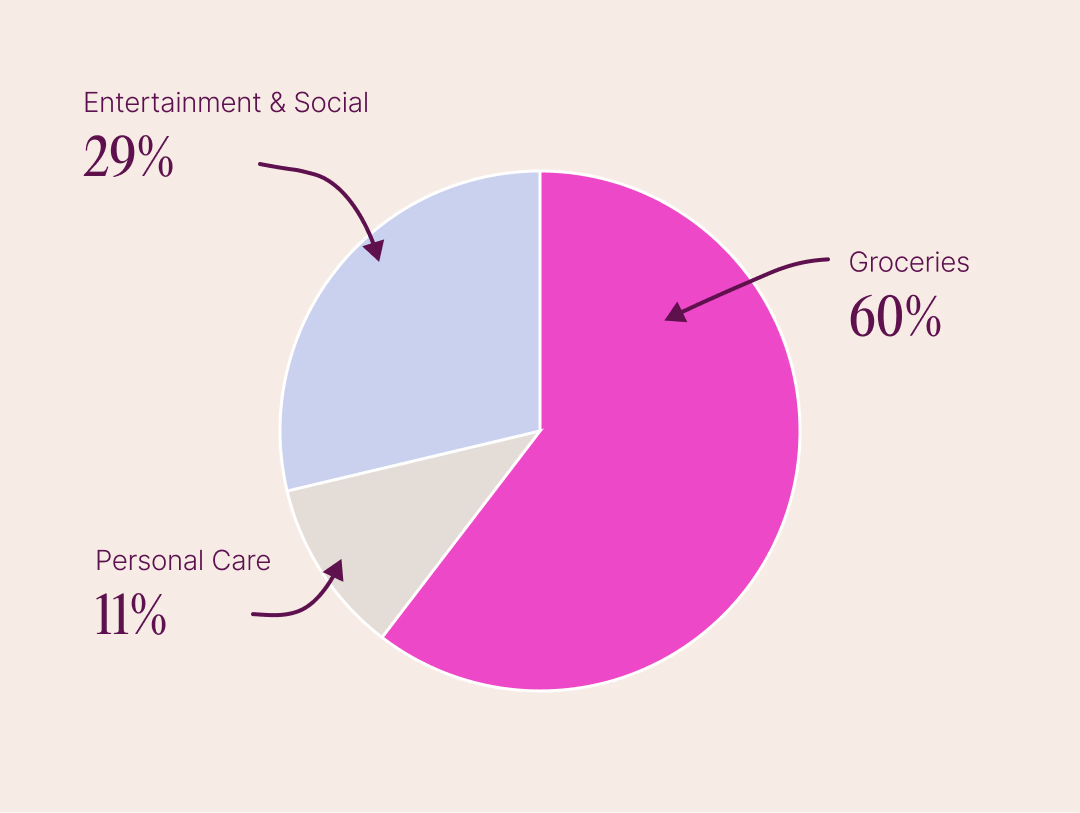

I am satisfied, and nothing comes as a surprise (anymore). I usually plan what to buy for dinner and look for the best prices, which often leads me to Netto. I know many experts recommend planning and buying groceries for the whole week in one go to optimize spending. However, with an athlete in the house and a teenager, I’m never quite sure how many people will be around for dinner throughout the week, so it ends up being more of a day-to-day decision. As a result, Monday, Tuesday, Friday, and Saturday shopping are fairly similar.

That said, I do have an Excel sheet where I track my grocery spending each week and month. It might seem boring, but compared to my past, I find it gives me a much-needed overview. In the past, without any control, I’ve had situations where my VISA card was unexpectedly blocked while I was at the store.

In the past, I would spend thousands on shopping, but now, I sell my clothes and mostly buy vintage items.

I set a budget for everything - food, haircuts, gifts, holidays, insurance, and savings. It’s all about having control, which brings me peace of mind. I’m no longer afraid of not being able to pay for things. My past was truly a nightmare, and many of my female friends still don’t know how much they spend on groceries, insurance, or clothes. It’s often their husbands who handle all of that.

My advice to all women: get involved with your finances, and give them - and yourself - the respect they/you deserve.

What I Spent in a Week

Monday – 306 kr. ($47)

- Grocery shopping at Netto: 306 kr. ($47)

Tuesday – 200 kr. ($31)

- Personal care products: approx. 200 kr. ($31)

Wednesday – 550 kr. ($85)

- Gift for a friend: approx. 550 kr. ($85)

Thursday – 0 kr. ($0)

- No spend-day: 0 kr. ($0)

Friday – 348 kr. ($54)

- Groceries & cleaning products from Netto: 348 kr. ($54)

Saturday – 502 kr. ($77)

- Grocery shopping at Kvikly: 502 kr. ($77)

Sunday – 0 kr. ($0)

- No spend day: 0 kr. ($0)

Total Weekly Spend: 1,906 Kr. ($294)