2/9/25

What I Spent This Week as an Accountant Making $80k

Ever wondered how others really manage their money?

Ever wondered how others really manage their money?

In the A Week in My Wallet series, we share it all, because talking about money shouldn't be off-limits. Every week, an anonymous member shares a week of their spending: no names, no filters, just honest stories about life's everyday financial choices.

Ready to join the conversation and help make money talk less taboo? Share your own story via our form here.

About Me

Your age: 31

Your city or region: Glasgow

Current Salary (before tax): £59,000 ($80,830)

Monthly Take-Home Pay (after tax): £3,671 ($5,029)

Household Income (if shared): £120,000 ($164,400)

Do you share expenses with someone? My partner

Occupation and/or Source(s) of Income: Accountant

Savings (amount + purpose, if you'd like to share):

£600 ($822)- 50/50 travel/long term savings

£360 ($493)- investments

£150 ($205)- emergency fund

(£570 [$781] pension contribution monthly, deducted from pay. My after-tax monthly pay amount includes this deduction)

Debt (type + amount): None

Assets (e.g. investments, owned property, other):

£121,000 ($165,770) in investments.

£48,680 ($66,688) of that is my pension; £72,320 ($99,082) is investments.

Vehicle (2014 Automatic Ford Focus)

Fixed Monthly Costs (your share only):

• Rent: £700 ($959)

• Bills & utilities: £218 ($298)

• Transport: £115 ($158)

• Groceries: £300 ($411)

• Investment contributions: see above £360 ($493)

Amount left each month after essentials (to spend, save or invest):

Approx £2,200 ($3,014).

£1,100 ($1,507) of that goes to my emergency fund, travel/long term, and investments as per above)

Dependents (if any):

None.

Growing up, did your parents or guardians educate you around money?

No. My mom was a single mother who had me when she was 19. When I was young, we lived in low-income housing while she went to university to get her degree. She was trying to figure things out herself. She had basic T Bonds, an RRSP (Canadian) and Pension through work, but there wasn’t a lot in way of an emergency fund, savings, or investments.

What was your first job and why did you get it?

Grocery store cashier when I was 15; I needed to save money for post-secondary education and weekend spending.

Did you worry about money growing up?

Yes. My mom separated from my stepfather when I was 16; they had a 1-year-old together at the time, and the separation was not very amicable. I helped to support my mom financially a lot during that time (16 - 24). She always paid me back, but I often had to lend her money to cover her monthly expenses.

I think this is the period where I became a good saver. As I got older, that turned into me focusing on growing my wealth to ensure I would always be financially independent, and money would not be a stressor, as I saw first-hand how consuming it can be.

From my very first job, I set up automatic withdrawals to a savings account on the day I got paid. As I got older and transitioned into new jobs and higher salary, that has always continued.

Similarly, once I had enough in savings, I knew I wanted to do more - and that is when I got into investing, through talking to friends' parents. Money with Katie on Instagram was a huge inspiration for me. She broke down finances in a really understandable way and provided a kind of road map in terms of how to create a budget, track your spending, and a guide for how much you should be spending on different areas of your life.

At what age did you become financially responsible for yourself and do you have a financial safety net?

At around age 15–18. I routinely lent money to my mom during this period, and built up a financial safety net by my early twenties. I lived at home while going to university, but paid partial rent and groceries. I moved out at age 25.

Do you worry about money now?

No. I feel confident in my ability to manage my finances. I earn a good salary, I have built myself a good base understanding of personal finances, and have gotten myself to a place where money does not cause me stress.

I have enough in savings that if something goes wrong (a popped tire on the side of the road, like last weekend) I can step back and remind myself that if the worst thing is that it is going to cost me a few hundred dollars, then that is fine and it will not impact my ability to pay my bills that month.

I track my spending weekly and finances monthly so that I am always aware of what I am spending. I try to be really cognizant of living within my means, and not giving in to lifestyle creep or wanting what others have. I try to recenter on what my priorities and values are.

What is your biggest money regret?

I don’t have one. I am incredibly proud of what I’ve done with the information I had.

What financial goals are you working towards?

I wanted to have $100,000 CAD ($73k USD) by age 30 (which I met), and am now working towards $200,000 CAD ($146k USD) by 35 (I'm a Canadian who has lived in the UK for the past two years, hence why the goal is in CAD, but finances are in £).

Who is your financial role model (if any), and why?

Myself, and Money with Katie.

Reflections on My Spending

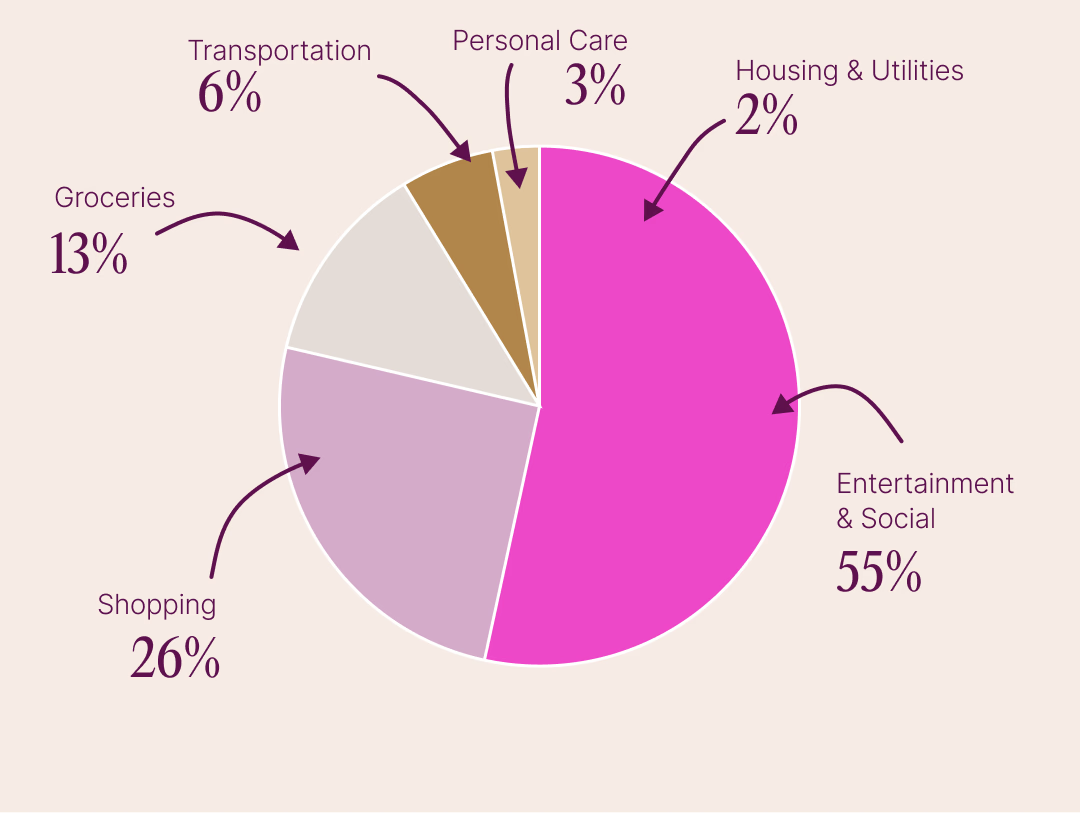

This was a big week for travel spending (I only included my half). I have a £250 ($343) monthly shopping budget which I used for vacation pieces. I generally do well at not spending money during the week, but it's the weekends that add up quickly.

What I Spent in a Week

Day 1 – Monday: £212 ($291)

• Free People flip flops: £40 ($55)

• CrossFit class: £12 ($16)

• Flights for summer trip: £160 ($219)

Day 2 – Tuesday: £37 ($51)

• Lunches @ work (soup): £2 ($3)

• Dinner & drinks with a friend: £35 ($48)

Day 3 – Wednesday: £0

• No spend this day

Day 4 – Thursday: £14.35 ($20)

• Lunch at work (soup): £2.35 ($3.22)

• CrossFit: £12 ($16)

Day 5 – Friday: £12.29 ($17)

• M&S snacks: £7.30 ($10)

• Amazon: £4.99 ($7)

Day 6 – Saturday: £136.33 ($187)

• Bakery: £6.45 ($9)

• Groceries: £16.40 ($22)

• Second grocery trip: £65.32 ($89)

• Gas: £48.16 ($66)

Day 7 – Sunday: £353 ($484)

• Market treasures: £25 ($34)

• Airbnb summer trip: £127 ($174)

• Airbnb summer trip: £98 ($134)

• Reformation: £128 ($175)

Total Weekly Spend: £765.97 ($1,050)